Previously, I discussed tariffs and the trade deficit. This post is about Trump’s proposal to use tariffs to fund projects.

The Council on Foreign Relations Discusses Tariffs

What Is a Tariff?

A tariff is a tax imposed on foreign-made goods, paid by the importing business to its home country’s government.

U.S. President Trump wielded tariffs more than any recent American president, particularly against China. President Biden has largely left these levies in place while imposing his own.

Who authorizes tariffs in the United States?

The Constitution grants Congress the power “to regulate commerce with foreign nations, and among the several states,” which it used for more than a century to impose tariffs. Perhaps most infamously, Congress raised close to nine hundred separate tariffs with the 1930 Smoot-Hawley Tariff Act, which many economists say worsened the Great Depression. But over the past ninety years, Congress has delegated more and more trade authority to the executive branch, in part a response to Smoot-Hawley.

These laws give the president the power to raise tariffs if foreign countries are found to be engaged in unfair trading practices, or if imported goods are deemed to be threatening critical domestic industries and thus harming national security. They also allow the president to impose tariffs if domestic industries are “seriously injured” by import competition, even if there is no alleged foul play.

Many presidents have exercised these powers, though Trump did so to a far greater extent than most of his predecessors, imposing tariffs affecting hundreds of billions of dollars worth of goods from China and some U.S. allies, including members of the European Union (EU). Biden has maintained most of Trump’s tariffs on China and introduced several of his own. However, he has reined in tariffs on EU member countries.

Who pays?

Importers pay tariffs to their home government, but most economists find that the bulk of tariff costs are passed on to consumers. This is particularly true for industries with small profit margins, such as retail.

Ignorance or a Lie?

Trump claims foreigners pay the bill. That either ignorance or a flat out lie.

US importers can either eat the cost or pass it on. In most cases it is the latter.

But foreign exporters can mask the exports by value added processes that hide the origin of the goods. This adds cost frictions as well, but at a lesser rate.

Tracking the Economic Impact of the Trump-Biden Tariffs

The Tax Foundation Tariff Tracker investigates the Economic Impact of Trump-Biden Tariffs.

Key Findings

- The Trump administration imposed nearly $80 billion worth of new taxes on Americans by levying tariffs on thousands of products valued at approximately $380 billion in 2018 and 2019, amounting to one of the largest tax increases in decades.

- The Biden administration has kept most of the Trump administration tariffs in place, and in May 2024, announced tariff hikes on an additional $18 billion of Chinese goods, including semiconductors and electric vehicles, for an additional tax increase of $3.6 billion.

- We estimate the Trump-Biden tariffs will reduce long-run GDP by 0.2 percent, the capital stock by 0.1 percent, and employment by 142,000 full-time equivalent jobs.

- Altogether, the trade war policies currently in place add up to $79 billion in tariffs based on trade levels at the time of tariff implementation and excluding behavioral and dynamic effects.

- Before accounting for behavioral effects, the $79 billion in higher tariffs amounts to an average annual tax increase on US households of $625. Based on actual revenue collections data, trade war tariffs have directly increased tax collections by $200 to $300 annually per US household, on average. Both estimates understate the cost to US households because they do not factor in the lost output, lower incomes, and loss in consumer choice the tariffs have caused.

- Candidate Trump has proposed significant tariff hikes as part of his presidential campaign; we estimate that if imposed, his proposed tariff increases would hike taxes by another $524 billion annually and shrink GDP by at least 0.8 percent, the capital stock by 0.7 percent, and employment by 684,000 full-time equivalent jobs. Our estimates do not capture the effects of retaliation, nor the additional harms that would stem from starting a global trade war.

- Academic and governmental studies find the Trump-Biden tariffs have raised prices and reduced output and employment, producing a net negative impact on the US economy.

Former President Trump Proposes an Up to $3,900 Tax Increase for a Typical Family

American Progress reports Former President Trump Proposes an Up to $3,900 Tax Increase for a Typical Family

Former President Donald Trump has been running on a 10 percent tax on every imported good entering the United States and a 60 percent tax on every imported good from China. The Center for American Progress Action Fund has calculated that this would amount to an annual $2,500 tax increase for a family in the middle of the income distribution.

Now, Trump has opened the door to an even larger tax increase by suggesting that the across-the-board tax on imports could go as high as 20 percent, saying:

We’re going to have 10 to 20 percent tariffs on foreign countries that have been ripping us off for years … We’re going to charge them 10 to 20 percent to come in and take advantage of our country.

Using the same methodology, CAP Action estimates that a 20 percent across-the-board import tax combined with the 60 percent tax on Chinese goods would amount to about a $3,900 tax increase for a middle-income family.* This includes a $200 tax increase on food; a $240 tax increase on oil and petroleum products; and a $210 tax increase on medicine.

A typical family would, therefore, pay between $2,500 to $3,900 from Trump’s import taxes, depending on the precise tax rate between 10 percent and 20 percent that various countries’ goods could be taxed at.

Americans Paid for the Trump Tariffs—and Would Do So Again

The CATO Institute concludes Americans Paid for the Trump Tariffs—and Would Do So Again

During a campaign stop in Wilkes-Barre, Pennsylvania, over the weekend (Aug. 17–18), former President Donald Trump told the audience that “a tariff is a tax on a foreign country. A lot of people like to say it’s a tax on us. No, […] it’s a tax that doesn’t affect our country.”

The statement is consistent with his repeated assertions throughout his presidency, during which he levied heavy tariffs on imported solar products, washing machines, steel, aluminum, and about 70 percent of all products from China.

Despite the former president’s claims to the contrary, however, there is overwhelming evidence that Americans bore the brunt of his tariffs—and would do so again if he is reelected and fulfills his campaign pledge to impose more aggressive protectionism.

As the Tax Foundation’s Erica York wrote in an excellent essay for Cato’s Defending Globalization series, both economic theory and practice—as demonstrated in the interactive decision tree below—teach that unless foreign sellers deliberately lower their prices (and thus, render a tariff ineffective for protectionist purposes), the importers and exporters of the country that imposes the tariff end up paying its cost. In the case of the Trump-era tariffs, the outcome was clear: Americans paid the tab.

The Trump campaign surely believes tariffs and protectionism are a winning message, but there’s reason to be skeptical. A recent Cato Institute survey found that a mere 1 percent of Americans said that trade and globalization are a top three issue for them, and large majorities worried about and were unwilling to pay for tariffs’ costs, including higher prices or lost jobs. No wonder that Trump pretends those harms don’t exist.

Why Trump’s Tariff Proposals Would Harm Working Americans

PIIE comments on the Regressive Nature of Trump’s Proposal

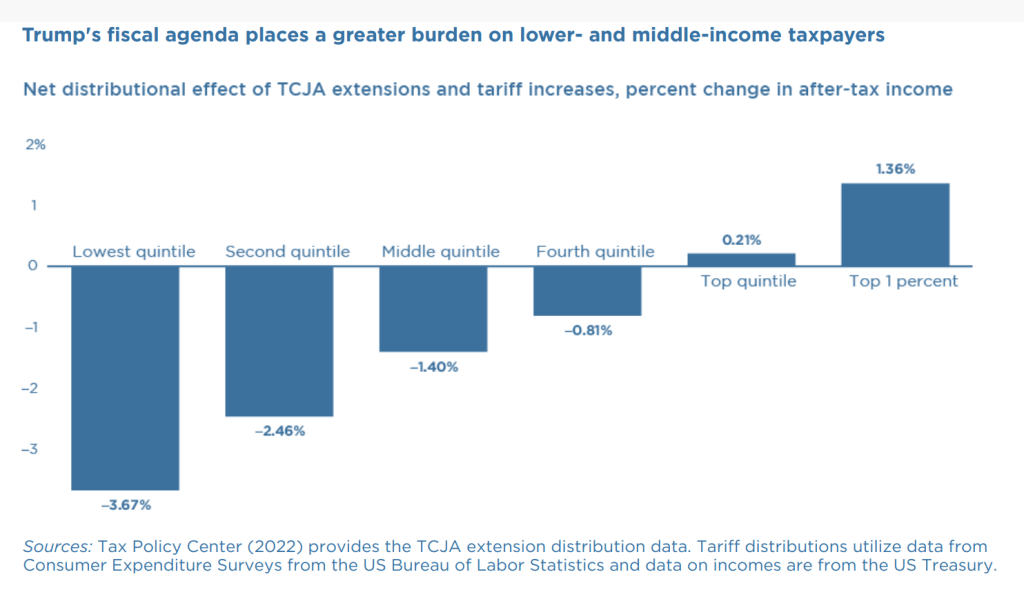

As fiscal policy, the Trump agenda amounts to regressive tax cuts, only partially paid for by regressive tax increases. A lower-bound estimate of costs to consumers indicates that the tariffs would reduce after-tax incomes by about 3.5 percent for those in the bottom half of the income distribution; tariffs would cost a typical household in the middle of the income distribution at least $1,700 in increased taxes each year. If executed, Trump’s latest tariff proposals would increase manifold the distortions and burdens created by the rounds of tariffs levied during the Trump administration (and sustained during the Biden administration), while inflicting significant collateral damage on the US economy. Domestic job creation claims for the 2018–19 return to protectionism have simply proved false.

This Policy Brief highlights the distributional implications of Trump’s proposed fiscal switch. First, we discuss the incidence of tariffs, reviewing recent literature that concludes that US purchasers of imports bear the burden of tariff increases. Second, we leverage recent research to provide approximate calculations for the cost of the higher proposed tariffs to US consumers, considering the impact of higher prices. Lower-bound estimates of the costs are substantial, nearly 2 percent of GDP. Third, we estimate the likely revenue consequences of Trump’s proposed tariffs, comparing them to the fiscal costs associated with extending the TCJA tax cuts. Upper-bound projections of tariff revenues would fall far short of what is needed to cover the tax cut extensions, even ignoring the negative effects of tariffs on economic activity that are likely to further dampen fiscal revenues. Fourth, we examine how the burden of tariffs is distributed across US households. Both the tariffs and candidate Trump’s tax proposals entail sharply regressive tax policy changes, shifting tax burdens away from the well-off and toward lower-income members of society. Finally, we describe why tariffs fail to meet other policy objectives, instead causing harm to many US workers and industries, prompting retaliation from trading partners, worsening international relations, and, in the end, expanding trade deficits.

Analytically, we can think of a tariff as the combination of a tax on domestic consumption, since it raises the price buyers pay domestically, and a subsidy to producers, since it raises the price producers face when they sell to domestic buyers. Tariffs are considered an inefficient way to raise revenue because they generate losses to domestic buyers that exceed the sum of benefits to producers and tariff revenues.

The scale of trade barriers proposed by candidate Trump is unprecedented, but their costs to the US economy is informed by the empirical evidence from studies of the 2017 tariffs on solar panels, washing machines, aluminum, steel and iron, and Chinese imports. Importantly, these studies convincingly find no evidence of terms-of-trade benefits for the United States from these tariffs. Rather, the data show that higher tariffs are fully reflected in higher prices for US buyers.

Tariffs are a regressive tax because tariffs are a tax on consumption and lower-income households consume a much higher share of their income than higher-income households.

Impact on the Trade Deficit

Former President Trump often claims that foreigners bear the burden of tariffs, despite the analysis above, and he plans to use tariffs to punish other countries for what he views as undesirable trade practices. For example, he points to trade deficits as indicators that the United States is being taken advantage of, suggesting that tariffs might right such wrongs.

These claims ignore the simple macroeconomic reality behind trade deficits. Countries that have low savings rates (both public and private) relative to their investment rates run trade deficits, and countries that have the opposite pattern run surpluses. Strong macroeconomies are also frequently associated with increased trade deficits due to greater investment and lower savings.

Since Trump’s proposed fiscal policies would likely increase the fiscal deficit and may appreciate the exchange rate, his policy suggestions are more likely to increase than reduce the trade deficit.

Trump Claims Tariffs Will Reduce the Trade Deficit

On September 26, I commented Trump Claims Tariffs Will Reduce the Trade Deficit. Let’s Fact Check.

Trump proposes 60 percent tariffs on China. Would that reduce the trade deficit? Where? How?

We already have overwhelming evidence that tariffs will not improve the trade deficit.

Nor can tariffs be used to pay down debt or fund much of anything,

We have the largest tariffs in decades, and although there was a tiny improvement with China, the US has a much bigger deficit elsewhere as China masked the origin of its exports.

Critical Materials Risk Assessment by the US Department of Energy

Please consider a Critical Materials Risk Assessment by the US Department of Energy

The US Department of Energy has placed some of the rare earth minerals we need for weapons systems, windmills, batteries, and aircraft on a critical materials list.

Nearly all of them are mined or refined in China. Yet Biden just blocked production in the US.

So, how might China respond to 60 percent tariffs?

Trump is willing to double down on tariff foolishness. Not only is it regressive, it’s inflationary madness.