The world is on a huge collision course with China and Trump will be at the helm.

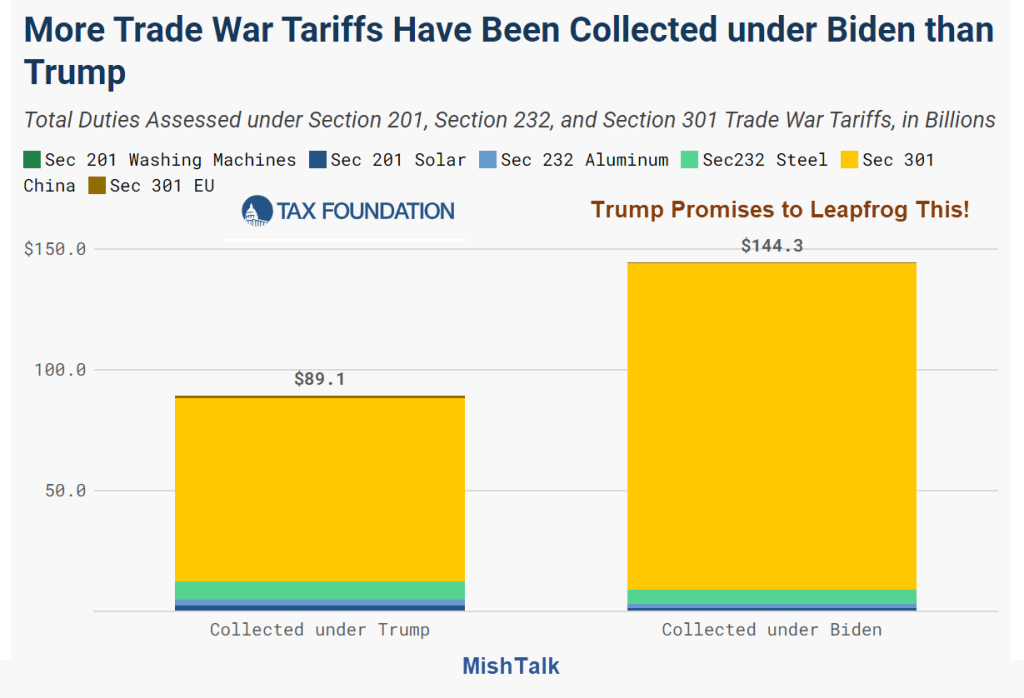

The Tax foundation has an excellent Tariff Tracker report: Tracking the Economic Impact of the Trump-Biden Tariffs.

Key Tariff Findings

- The Trump administration imposed nearly $80 billion worth of new taxes on Americans by levying tariffs on thousands of products valued at approximately $380 billion in 2018 and 2019, amounting to one of the largest tax increases in decades.

- The Biden administration has kept most of the Trump administration tariffs in place, and in May 2024, announced tariff hikes on an additional $18 billion of Chinese goods, including semiconductors and electric vehicles, for an additional tax increase of $3.6 billion.

- We estimate the Trump-Biden tariffs will reduce long-run GDP by 0.2 percent, the capital stock by 0.1 percent, and employment by 142,000 full-time equivalent jobs.

- Before accounting for behavioral effects, the $79 billion in higher tariffs amounts to an average annual tax increase on US households of $625. Based on actual revenue collections data, trade war tariffs have directly increased tax collections by $200 to $300 annually per US household, on average. Both estimates understate the cost to US households because they do not factor in the lost output, lower incomes, and loss in consumer choice the tariffs have caused.

- Candidate Trump has proposed significant tariff hikes as part of his presidential campaign; we estimate that if imposed, his proposed tariff increases would hike taxes by another $524 billion annually and shrink GDP by at least 0.8 percent, the capital stock by 0.7 percent, and employment by 684,000 full-time equivalent jobs. Our estimates do not capture the effects of retaliation, nor the additional harms that would stem from starting a global trade war.

- Academic and governmental studies find the Trump-Biden tariffs have raised prices and reduced output and employment, producing a net negative impact on the US economy.

Economic Effects of Proposed Tariffs

[Regarding point four, the Tax Foundation explains:] The actual cost to households is higher than both the $600 estimate before behavioral effects and the $200 to $300 after, because neither accounts for lower incomes as tariffs shrink output, nor the loss in consumer choice as people switch to alternatives that do not face tariffs.

In 2023, goods imports totaled $3.1 trillion and imports from China totaled $421.4 billion. With no behavioral effects, the universal tariff would raise taxes by $311 billion, while separately lifting the average tariff rate on Chinese goods to 60 percent would raise about $213 billion. Actual revenue raised would be significantly lower because of avoidance and evasion, falling imports, and lower incomes resulting in lower payroll and income tax revenues.

We estimate the proposed tariffs would reduce long-run GDP by 0.8 percent, the capital stock by 0.7 percent, and hours worked by 684,000 full-time equivalent jobs. The reason tariffs have no impact on pre-tax wages in our estimates is that, in the long run, the capital stock shrinks in proportion to the reduction in hours worked, so that the capital-to-labor ratio, and thus the level of wages, remains unchanged.

Tariffs are a Tax – Who Pays the Tax?

A Tax Policy center 2018 article explains What Is A Tariff And Who Pays It?

What is a tariff?

A tariff is a tax on imported goods. Despite what the President says, it is almost always paid directly by the importer (usually a domestic firm), and never by the exporting country. Thus, if the US imposes a tariff on Chinese televisions, the duty is paid to the US Customs and Border Protection Service at the border by a US broker representing a US importer, say, Costco.

The Chinese government pays nothing, just as the US government pays no tax to Canada for that nation’s tariffs on imported dairy products.

Who actually pays the tariff?

OK, so the importer remits the tariff to its nation’s customs service, but who really pays the tax on imported goods? The answer, I am sorry to say is, it depends.

A business will, if it can, pass its higher after-tax costs on to consumers. Thus, the price of Chinese TVs sold in the US may rise rapidly. But the firms selling those TVs eventually will face competition from companies that sell lower-cost TVs made in a third country that is not subject to the import tax. In that case, some of the tax may be paid by the firm’s shareholders in the form of lower profits or by its workers in the form of lower compensation.

The Repercussions

Trump’s 60 percent tax on Chinese imports won’t raise the estimated $213 billion because trade with China could come to a crashing halt.

Also, there is roughly zero chance that China would fail to respond some how with the most likely way buying more European goods, including planes. Boeing, GE, Honeywell, Collins, and Parker Aerospace exports would take a hit.

European exporters and manufacturers would benefit at the expense of US manufacturers.

China would certainly buy less US agricultural goods. But with agricultural products, it’s not easy for other countries to step up production.

In the US, the cost of a new washing machine would likely go up by hundreds of dollars, curtailing demand.

The cost of nearly everything at Walmart with perhaps the exception of food will rise.

Regressive Tax Hikes

PIIE explains Trump’s Tariff Proposals Would Harm Working Americans.

Tariffs have a negative impact on both efficiency and economic growth, but the burden of tariffs is felt differently across the population.

In the second decile, consumers spend 85 percent of their after-tax income, and this fraction declines steadily across the deciles, falling below 35 percent for the top decile. This pattern is at the root of why one might expect tariffs to be regressive taxes: lower-income households consume a much higher share of their income, and tariffs are a tax on consumption. As reviewed in Meng, Russ, and Singh (2023), the literature has consistently found that tariffs are regressive taxes in the United States, with no notable exceptions.

President Biden, despite having ample opportunity, has failed to remove the tariffs on China levied during the Trump presidency. Tensions with China have no doubt made it politically difficult to reverse many of these tariffs, but the tariffs continue to harm American households, although to a far smaller degree than Trump’s proposed tariffs would do, since they have about one-fifth the impact.

Although tariffs are clearly not effective and are even harmful, they are nonetheless perceived favorably by many. The politics therefore make tariffs, an unfortunate policy choice, difficult to undo. And that political economy consideration is yet another reason why the United States should not “double-down” on such a wrong-headed policy in the time ahead. In sum, tariffs should be rejected on both fiscal policy grounds and on traditional trade policy grounds.

Tariffs are a regressive and distortionary source of public finance, and they do not help the groups they are intended to help. They instead introduce new economic inefficiencies and collateral damage, and they make it more difficult to work cooperatively with allies and partners to solve our most vexing international problems.

Avoidance

China will undoubtedly seek avoidance measures to prevent the loss of exports. For starters, China can route goods to other countries to mask their origin.

Also, modifications made in intermediate destinations can change the origin.

Avoidance maneuvers will increase costs but bring in little revenue.

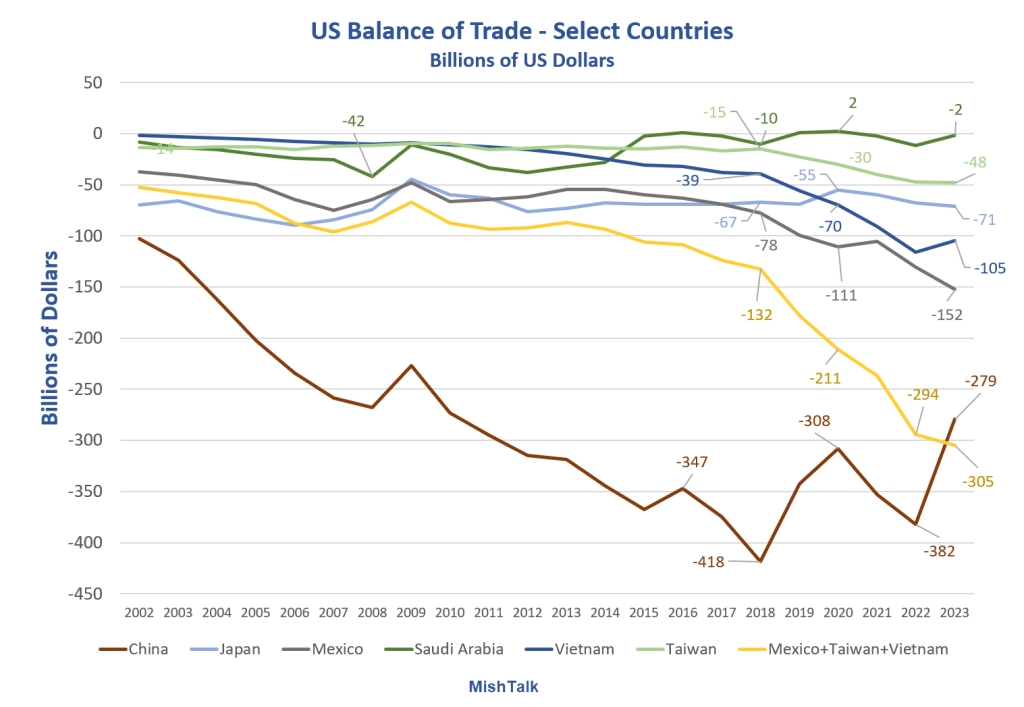

The Futility of the US Trade War With China in Two Pictures

Let’s check in on the progress of the US trade war with China that Trump started and Biden continued.

I discussed avoidance in my May 20, 2024 post The Futility of the US Trade War With China in Two Pictures

Balance of Trade Since 2018

- China from -418 to -279

- Mexico from -78 to -152

- Vietnam from -70 to -105

- Japan from -55 to -71

- Taiwan from -10 to -48

- Mexico+Taiwan+Vietnam from -132 to -305

China Shock II Is Coming, the EU Will Be Hit Hard, Then the US

On May 17, I commented China Shock II Is Coming, the EU Will Be Hit Hard, Then the US

Germany is feeling the pinch of China shock. But the US is on deck too. A global trade war looms.

German exporters are getting crushed by China. The EU as a whole cannot compete. The US is responding with massive tariffs.

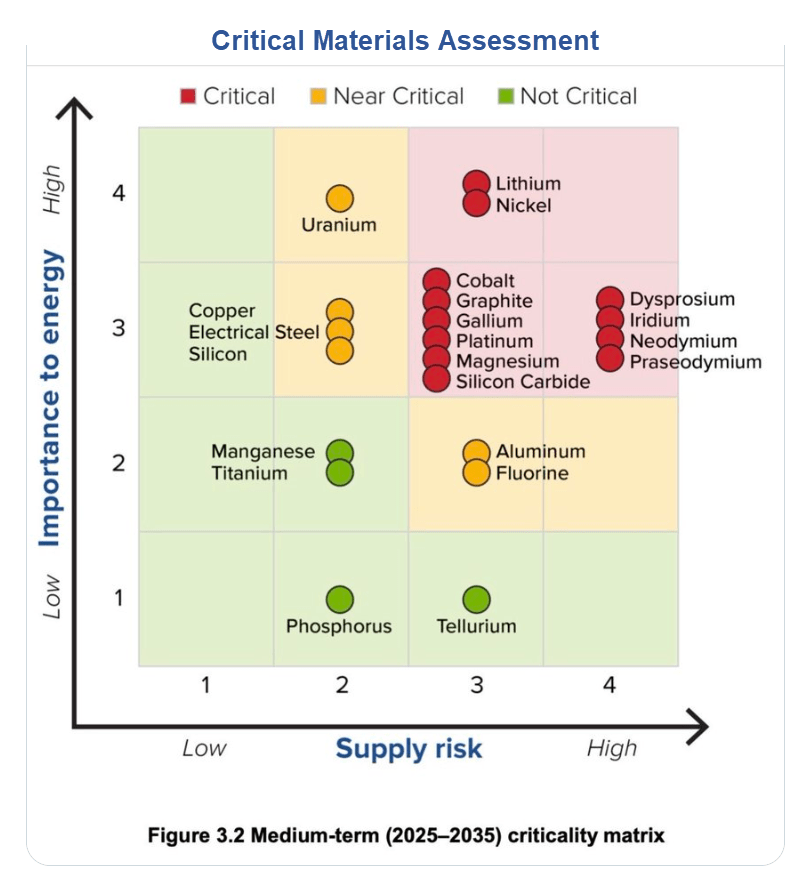

China will retaliate against US tariffs. One way might be to stop exports of rare earth minerals used in cell phones, EV, computers, wind turbines, and military guidance systems.

Critical Materials Risk Assessment by the US Department of Energy

Critical Materials diagram of risk vs importance by the Department of Energy.

Please consider a Critical Materials Risk Assessment by the US Department of Energy

The US Department of Energy has placed some of the rare earth minerals we need for weapons systems, windmills, batteries, and aircraft on a critical materials list.

Nearly all of them are mined or refined in China. Yet Biden just blocked production in the US.

The world is on a huge collision course with China and Trump will be at the helm.