The Bloomberg consensus estimate is 0.2 percent. CPINow from the Cleveland Fed is 0.18 percent.

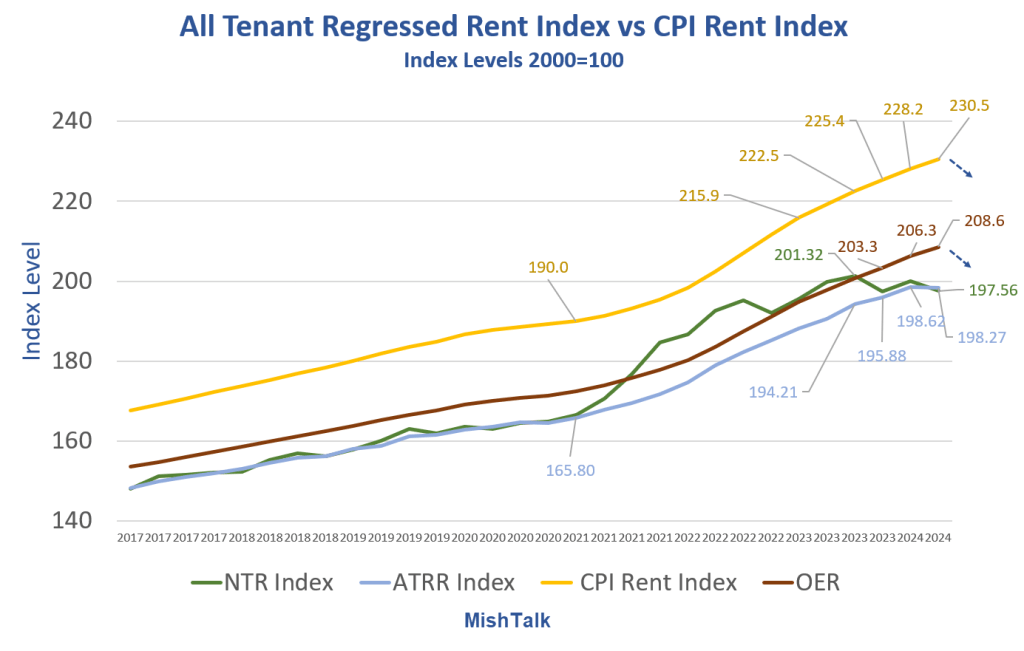

Chart Notes

- ATRR is an index created by Philadelphia Fed economists in cooperation with the BLS. It includes both new and existing leases unlike flawed models based on new leases only.

- Rent is the BLS measure of non-owner occupied rent, the typical apartment lease. It’s called rent of primary residence.

- OER stands for Owners’ Equivalent Rent. It is the BLS measure of the rent someone would pay to rent their own house, unfurnished, without utilities.

Quarter-over-quarter ATRR fell from 1.11 percent to negative 0.18 percent. Given a lag of ~1 quarter, this will soon hit the CPI via OER and Rent.

I explained the above chart in Year-Over-Year Rent Inflation Is About to Fall Sharply

The quarter-over-quarter ATRR measures are more volatile than I like, but they are quickly mean-reverting. I suspect volatility is due to the NTR [New Tenant] component where confidence ranges improve over time.

Once again, note the lead time of ATRR over rent and OER of about one quarter. This is very useful.

My CPI Guess

A the risk of looking silly, I will guess 0.0 percent month-over-month with a decent chance of a negative print. I don’t rule out a small negative revision to last month.

I am basing my guess on improved reading in both Owners’ Equivalent Rent (OER) and energy.

All Tenant Regressed Rent Index vs CPI Rent Index 2024-Q2

NTR peaked three quarters ago. ATRR peaked one quarter ago. Together they suggest flat to slightly declining measures of rent and OER starting soon.

Is Now Too Soon?

I may be early by a month or two. But based on the above chart I would not all all be surprised to see OER come in at 0.1 percent or negative. Perhaps last month will be revised lower.

Gasoline prices are down by $0.17 from a month ago. That’s about 4.9 percent. We need to round that lower to 2.6 percent or so because the drop was gradual, not big bang.

I don’t have a good handle on food, but I expect energy will more than offset food on a contribution to net CPI basis.

CPI Year Over-Year

The Bloomberg consensus is 2.6. The low was 2.4 percent. I will go with the low.

This calculation is pretty easy. Take the year-over-year CPI, currently at 2.9 percent, subtract 0.5 percentage points (the monthly increase a year ago), then add the current month-over-month CPI rate.

Any reading 2.5 percent or lower (monthly reading 0.1 percent or lower) will increase the odds of a 50 basis point cut by the Fed this month. So would negative revisions.

Earlier today I noted Fed Beige Book Conditions Are Worse Now Than the Start of the Great Recession

Also note BLS Negative Job Revisions 15 of Last 21 Months

Well, I’m sure that’s nothing too.