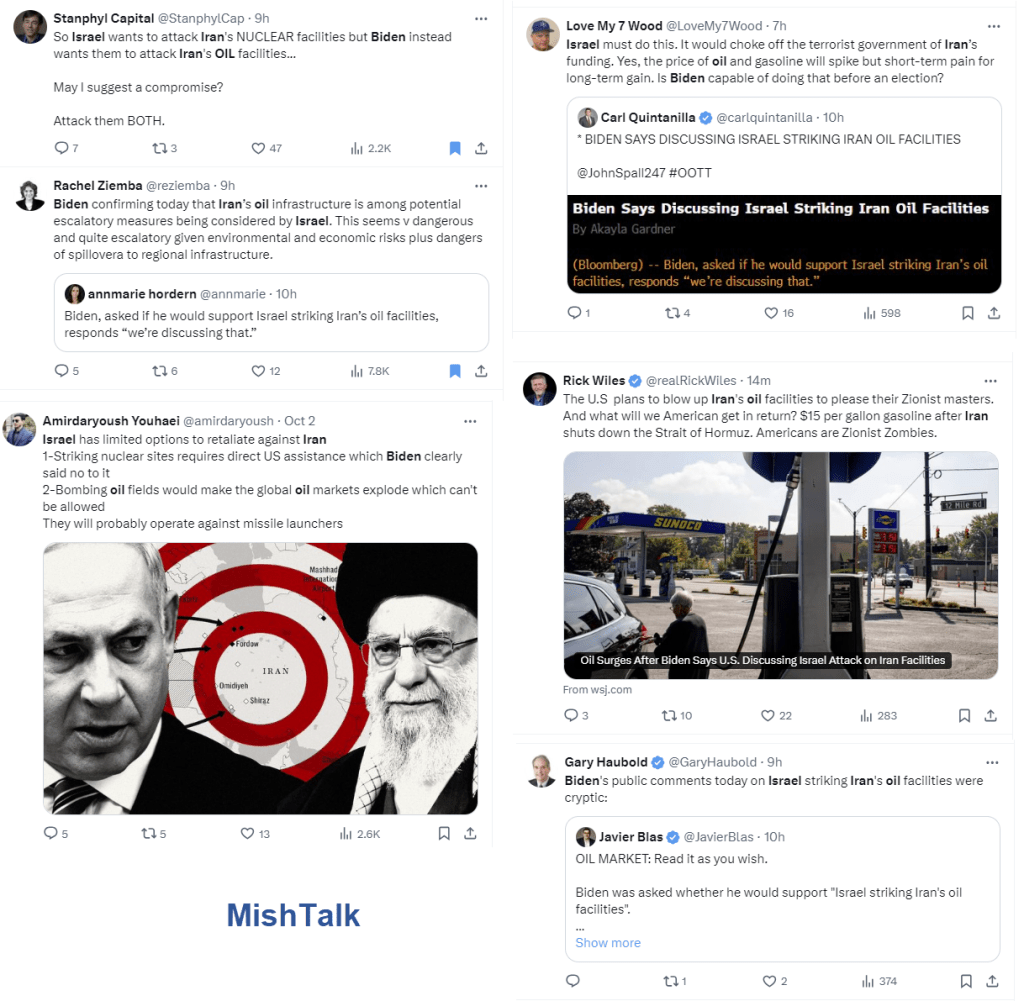

Israel and President Biden have discussed attacking Iran’s oil refineries. What then?

Oil Surges After Biden Says U.S. Discussing Israel Attack on Iran Facilities

The Wall Street Journal reports Oil Surges After Biden Says U.S. Discussing Israel Attack on Iran Facilities

A rise in oil prices intensified Thursday after President Biden suggested that U.S. officials are considering whether to support an Israeli strike on Iranian oil facilities, a move that could push gasoline prices higher just weeks before the presidential election.

Benchmark U.S. crude jumped 5.1%, to $73.71, its largest one-day gain since the early stages of Israel’s war on Hamas a year ago. The tremors weighed down U.S. stock indexes and left investors scrambling to understand the potential fallout of a broader war.

Asked if he would support Israel attacking Iran’s oil facilities, Biden replied, “We’re discussing that,” before adding “I think that would be a little…” and trailing off.

We’re Discussing That

Biden Video Link in case above Tweet does display

Other Reactions

As you can see, there are extreme views in opposite directions.

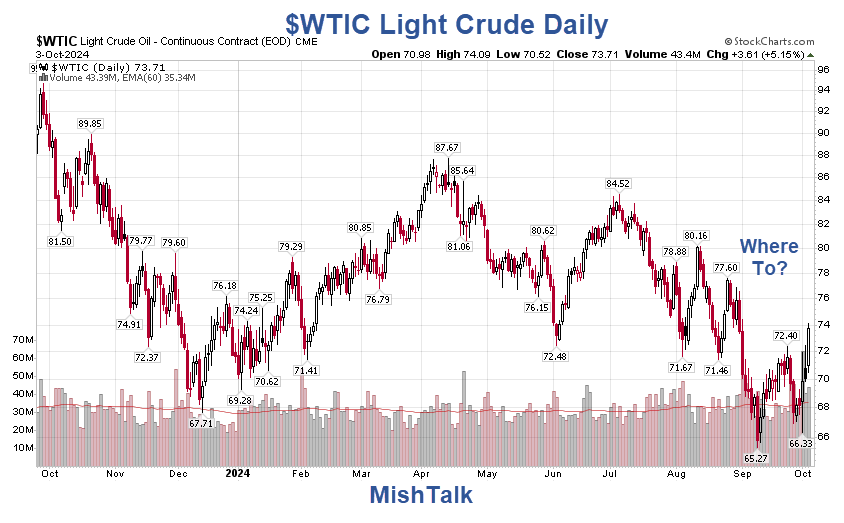

$WTIC Light Crude Daily

There is almost no technical information in the above chart. On the other hand, the monthly chart provides an interesting view.

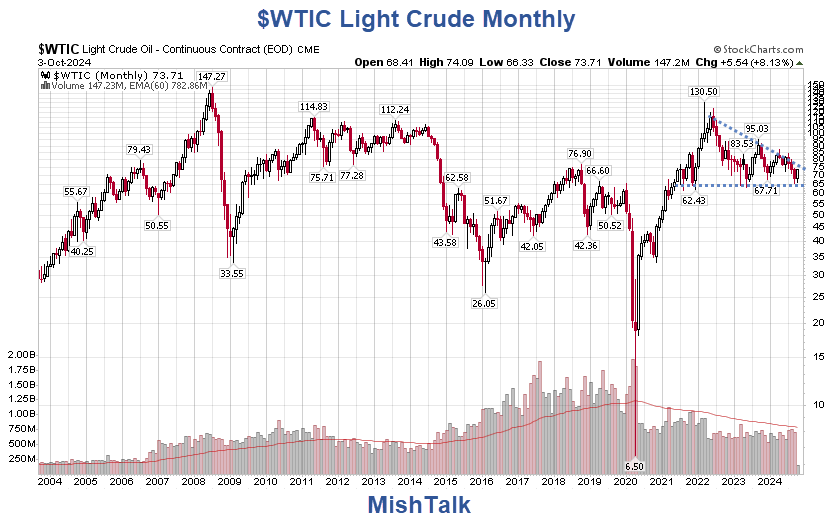

$WTIC Light Crude Monthly

A descending triangle is a bearish formation. The expected break would be for lower prices.

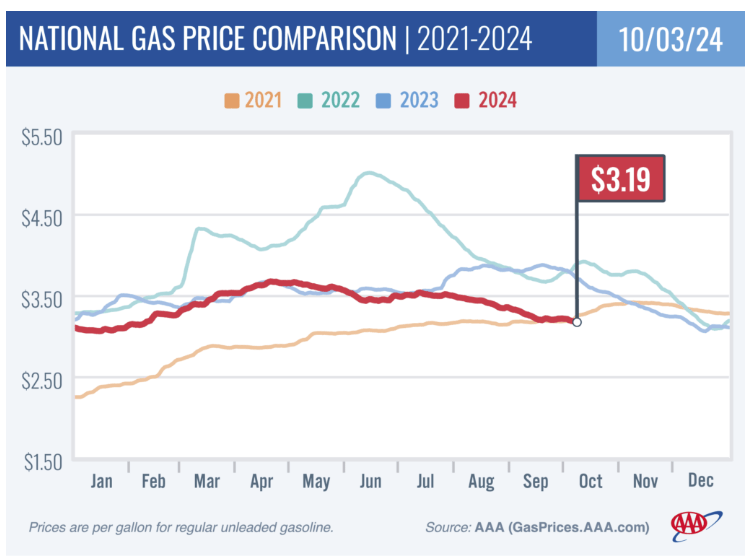

Pump Prices Resume Falling, But For How Long?

Despite the jump in oil prices over the past few days, prices at the pump have not risen.

The AAA asks Pump Prices Resume Falling, But For How Long?

“Despite the threat of war and a hurricane season that is still percolating, domestic gasoline prices are edging lower,” said Andrew Gross, AAA spokesperson. “There are now 18 states east of the Rockies with averages below $3 a gallon. And OPEC+ is saying, at least for now, they will increase production starting December 1st, putting even more downward pressure on pump prices.”

That is the recessionary outlook based on falling demand.

However, a major supply disruption would change the fundamental and technical outlook, at least temporarily.

For all the chatter over a possible attack, the market does not seem all that concerned, at least yet.