Key Points

- The average home loan amount for Australian owner-occupiers has hit a new high.

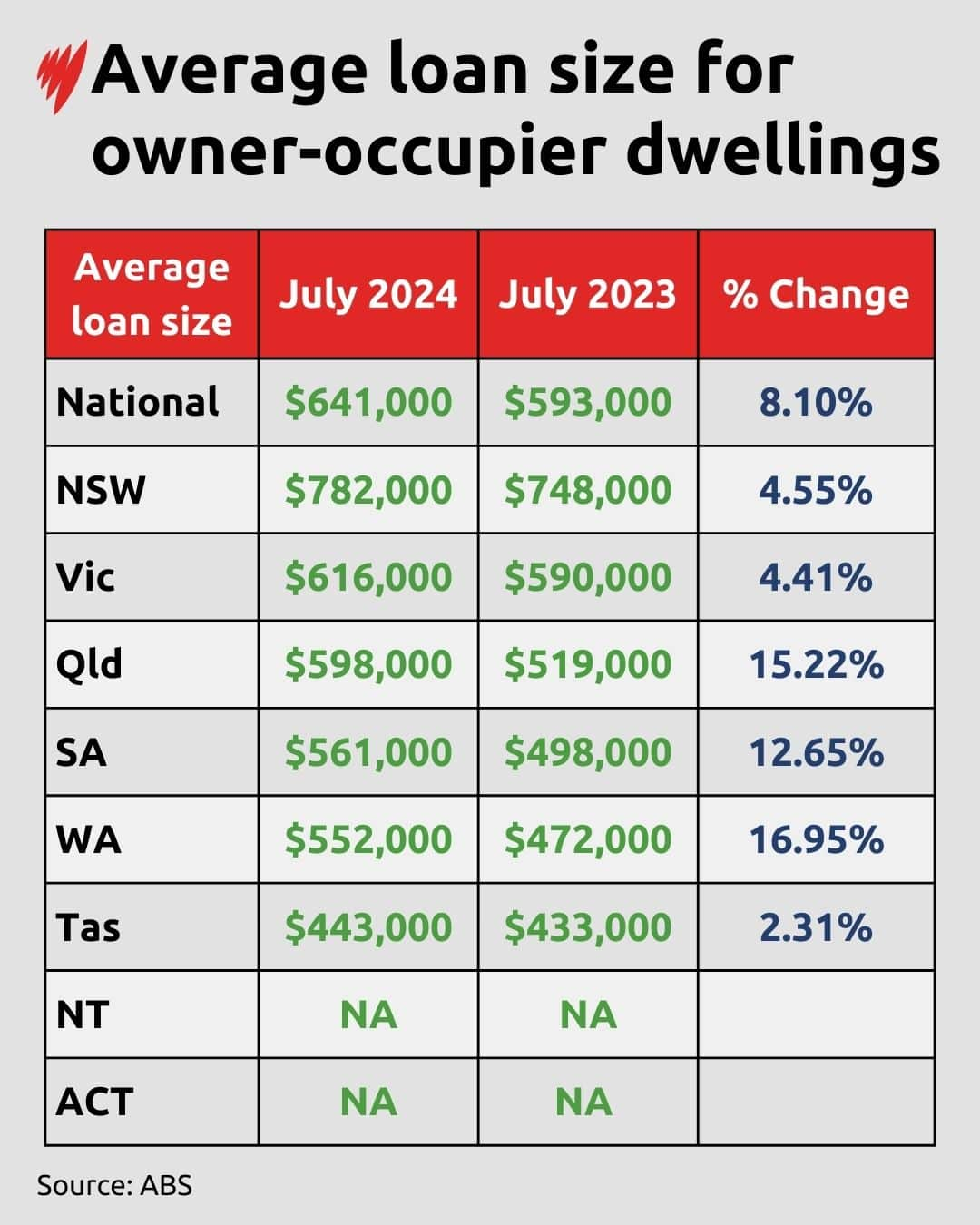

- The average loan size for owner-occupier dwellings has risen 8 per cent over the last year.

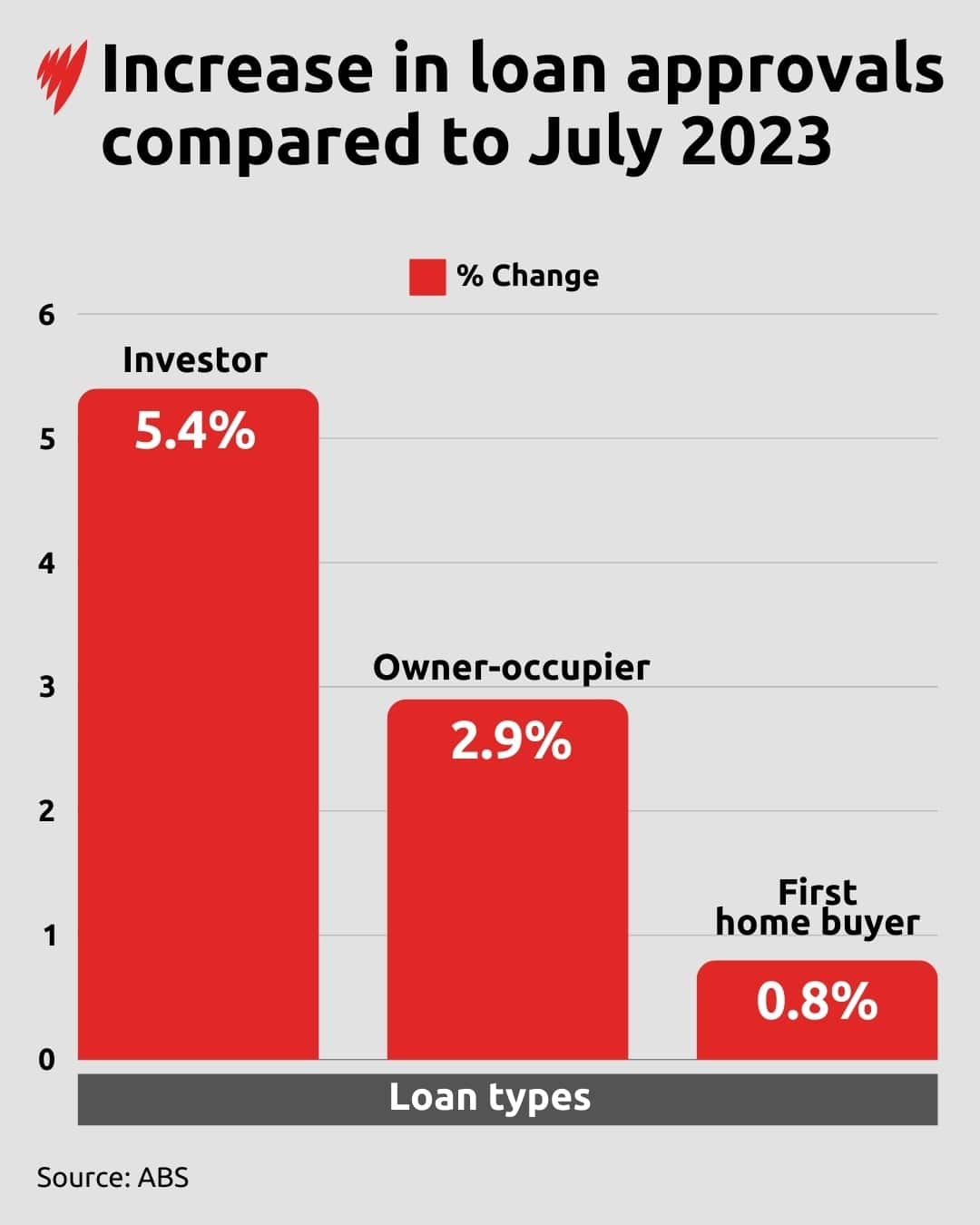

- Investors continue to dominate the market with the investor approval rate almost double that of owner-occupiers.

This figure includes the cost of construction as well as the purchase of new dwellings and existing dwellings.

Owner-occupier home loans

Western Australia has experienced the highest increase in percentage terms. The average home loan amount in Western Australia has gone from $472,000 to more than $552,000 — an increase of nearly 17 per cent.

Source: SBS News

Meanwhile, the price increase in Tasmania is the lowest of all the states at 2.3 per cent.

The ABS has not released similar data for the NT and ACT.

Australia’s housing crisis

She said Australia’s lowest-income households can only afford 1 per cent of houses sold and the median-income household now has to wait a decade to save enough for a deposit.

Investor’s market

While many owner-occupiers struggle to buy a house, Australia’s real estate market continues to attract more investors than those seeking to move into the properties they buy, the ABS data shows.

Compared with 12 months ago, investor loan approvals rose 5.4 per cent, almost double that of owner-occupier loans at 2.9 per cent.

This is close to the record high of $11.8 billion in January 2022.

Mish Tan, ABS head of finance statistics, said: “Investors have continued to see the largest growth in new loans over the past year, increasing more than a third in value since July 2023.”

“The increased investor activity we’re seeing in the lending statistics is mostly because more loans are being approved, and is only partly driven by higher dwelling prices.”