The Fed is concerned about inflation and jobs. It’s the latter that will be the bigger problem in the near-term. The Fed is behind the curve in jobs.

Fed FOMC statement

Please consider the FOMC Statement from the Fed’s July 31 meeting (emphasis mine).

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals continue to move into better balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The Shift

This is a shift away from inflation towards a balanced look at inflation and jobs.

Regarding jobs, I believe the Fed is behind the curve.

We have a jobs report on Friday, but there will be no solid reason to believe strong jobs growth if that’s what the BLS reports.

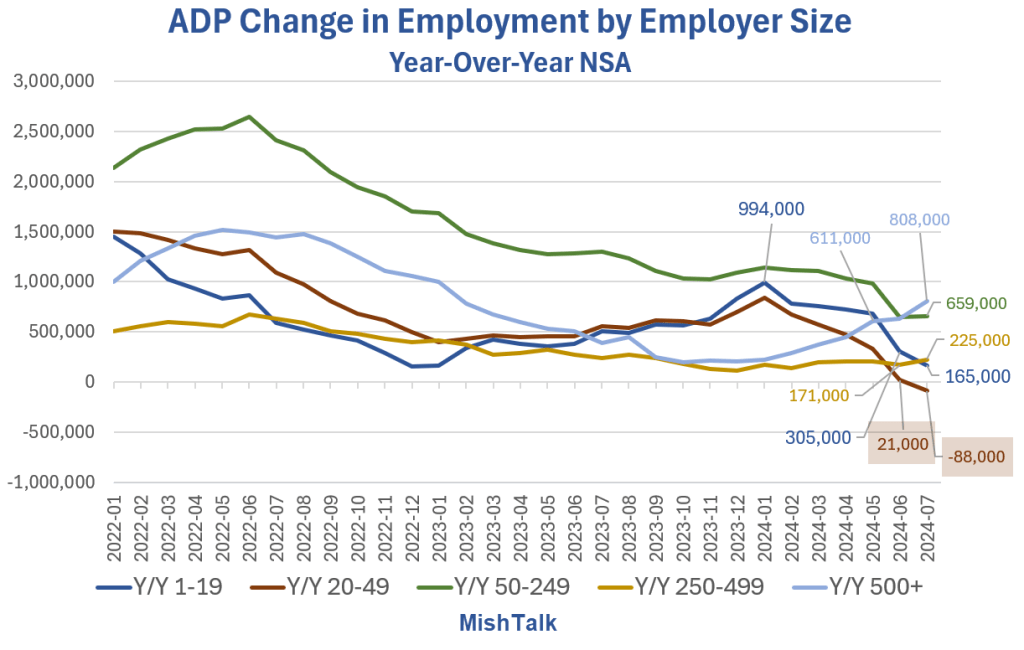

Small Business Employment Growth Is Now Negative

I discussed jobs earlier today in Small Business Employment Growth Is Now Negative (and What It Means)

ADP data shows year-over-year payroll growth is negative 88,000 for small corporations sized 20-49. Trends are negative in all but large corporations.

Given serious lags between downturns in the economy and downturns in jobs, coupled with questionable BLS models, I am certain the Fed is behind the curve in half of its mandate.

It’s debatable whether the Fed should have a dual mandate, but it does. And the Fed will react that way. I would not at all be surprised by a 50 basis point cut in September.