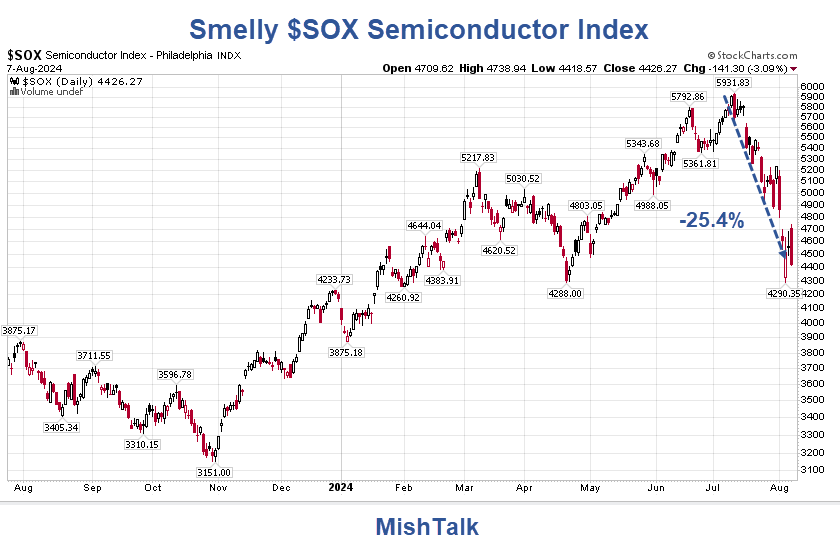

The $SOX semiconductor index is down again today led by Super Micro Computer (SMCI) and Nvdia (NVDA).

Smelly $SOX

AI Server Margin Anxieties

Yahoo!Finance reports Super Micro’s Weak Profit Fuels AI Server Margin Anxieties

Super Micro Computer Inc.’s shares slid on Wednesday after the company reported revenue and profit that missed analysts’ estimates, outweighing an annual sales outlook that was billions of dollars above Wall Street projections.

Profit, excluding some items, was $6.25 a share in the period ended June 30, the company said Tuesday in a statement. That fell short of Super Micro’s previous forecast and the $8.25 average analyst estimate. Sales were $5.31 billion, compared with an average projection of $5.32 billion, according to data compiled by Bloomberg.

A jump in demand for the equipment that powers artificial intelligence software has helped drive sales at San Jose, California-based Super Micro, which makes data center servers. The company forecast revenue of $26 billion to $30 billion in the fiscal year ending June 30, 2025. Analysts, on average, estimated $23.6 billion.

Still, investors are worried about the longer-term profitability of AI-optimized servers sold by companies like Super Micro, Dell Technologies Inc., and Hewlett Packard Enterprise Co., said Woo Jin Ho, an analyst at Bloomberg Intelligence. Super Micro missing its own profitability targets in the recent quarter will likely fuel these anxieties, he said.

Super Micro also announced a 10-for-1 stock split, with trading beginning Oct. 1. The shares have more than doubled in value this year and been added to the S&P 500 and Nasdaq 100 indexes following increased demand for servers. Still, the stock has declined about 48% from a peak in March.

Nvidia stock falls 5%, Chip Stocks Sink

Also consider Nvidia stock falls 5%, chip stocks sink as Wall Street calls out ‘tremendous opportunity’ after sell-off

Nvidia (NVDA) stock fell more than 5% on Wednesday, erasing gains from early in the session as chip stocks led the way lower during a trading session that saw all three major indexes close in red figures.

The sell-off in Nvidia and other chip names came despite a bullish note from Piper Sandler analysts published Wednesday, which pointed investors to a “tremendous opportunity” to buy some chip names following sector’s recent sell-off.

Are the “Magnificent 7” Stocks Today’s Version of the “Nifty Fifty”?

On August 4, I asked Are the “Magnificent 7” Stocks Today’s Version of the “Nifty Fifty”?

The “Magnificent 7” are TSLA, AAPL, META, GOOG, MSFT, AMZN, NVDA. Buy and hold forever?

Tremendous Opportunity

Nothing is buy and hold forever.

The tremendous opportunity is to take some chips off the table and raise some cash. Individuals can do that, but in aggregate it’s impossible.

Someone will ride every stock to wherever they are headed.