I am increasingly confident a recession has started or soon will. Yet despite weak data, Treasury yields rose. What’s happening?

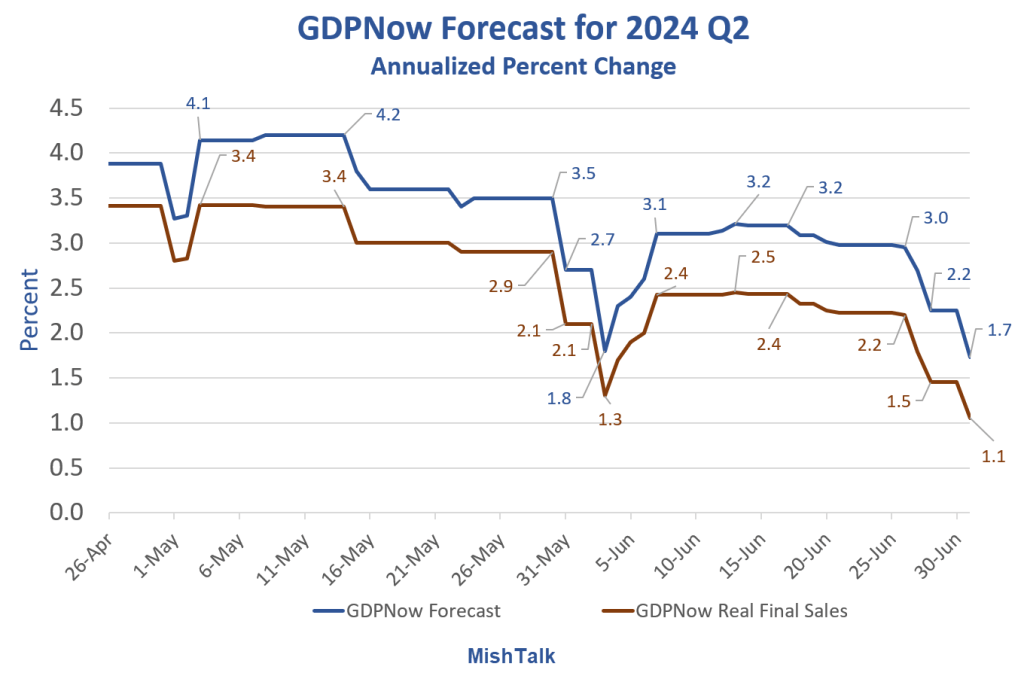

I discuss Treasury yields below, but first let’s discuss the chart above and the weakening data.

Key Point on Real Final Sales

Nearly everyone focuses on the headline number of 1.7 percent.

But its Real Final Sales (RFS) that matters. The difference between the numbers is inventory adjustment, Change in Private Inventories (CIPI) which nets to zero over time.

RFS is the real bottom line estimate for the economy and the one the NBER will use to call a recession.

At 1.1 percent and falling fast, the number looks very recessionary.

What Happened?

July 1: Today, in response to ISM and the construction spending, the contribution for Gross Private Domestic investment fell from from 1.51 PP to 1.20 PP.

June 27: The GDPNow contribution for net exports fell from -0.56 to -0.95.

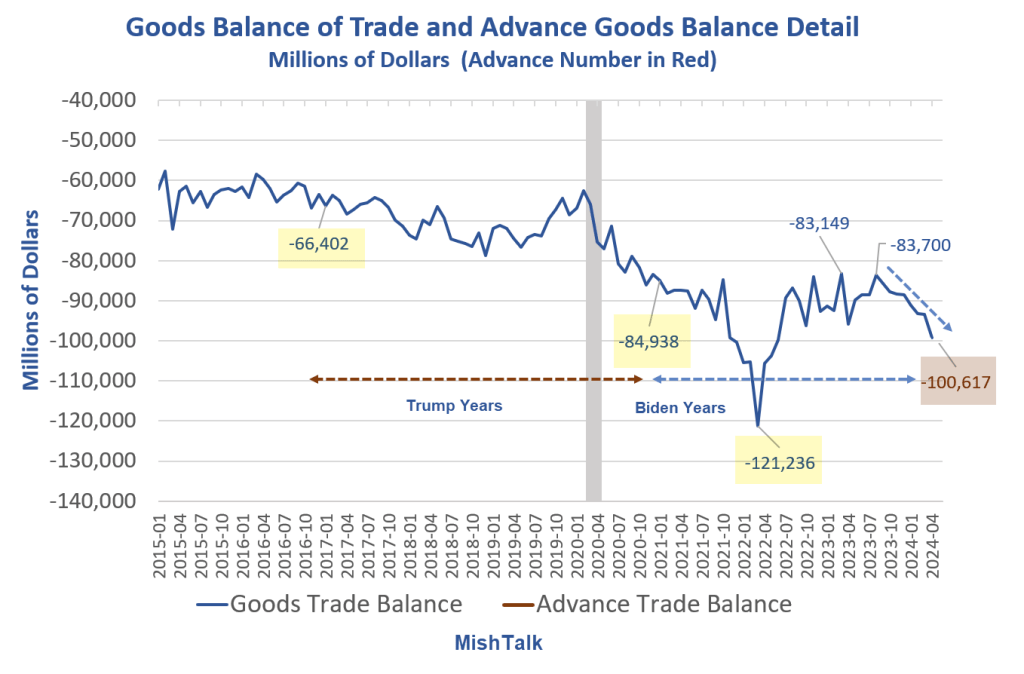

Another Terrible Trade Report, Plus a Spotlight On Not Winning Big

On June 28, I commented Another Terrible Trade Report, Plus a Spotlight On Not Winning Big

Dear tariff fans (both parties), let’s check in on how we are doing. …

When I saw that report, I made a mental note that the GDPNow forecast would take a big hit.

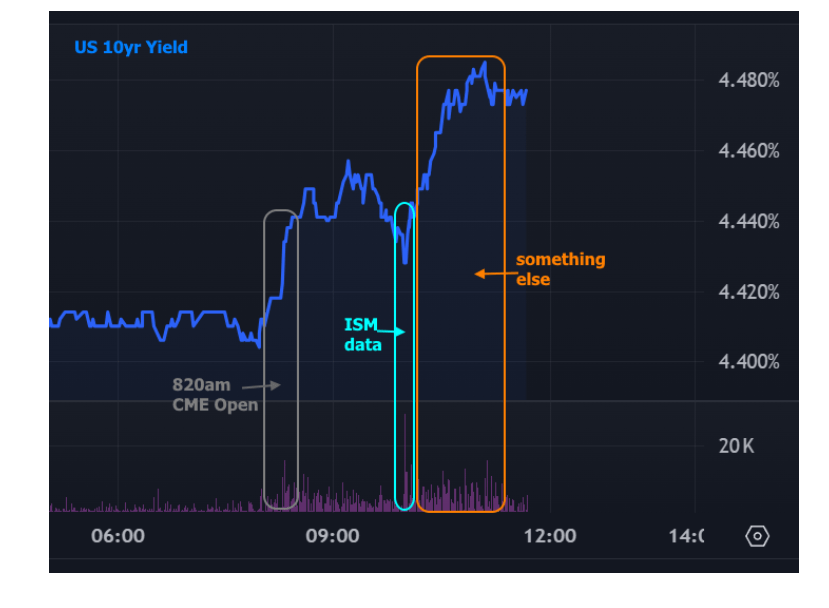

Yet Another Counterintuitive Sell-Off After Friendly Data

Matthew Graham on Mortgage News Daily commented Yet Another Counterintuitive Sell-Off After Friendly Data

Bonds are getting nervous about a GOP sweep because whether it’s red or blue, a one party sweep has bad implications for Treasury supply.

Bear Steepener

Not One Thing

Good coverage. I agree it's not just "one thing" right now. https://t.co/2SOuJkaoi8

— Matt Graham (@MG_MBS) July 1, 2024

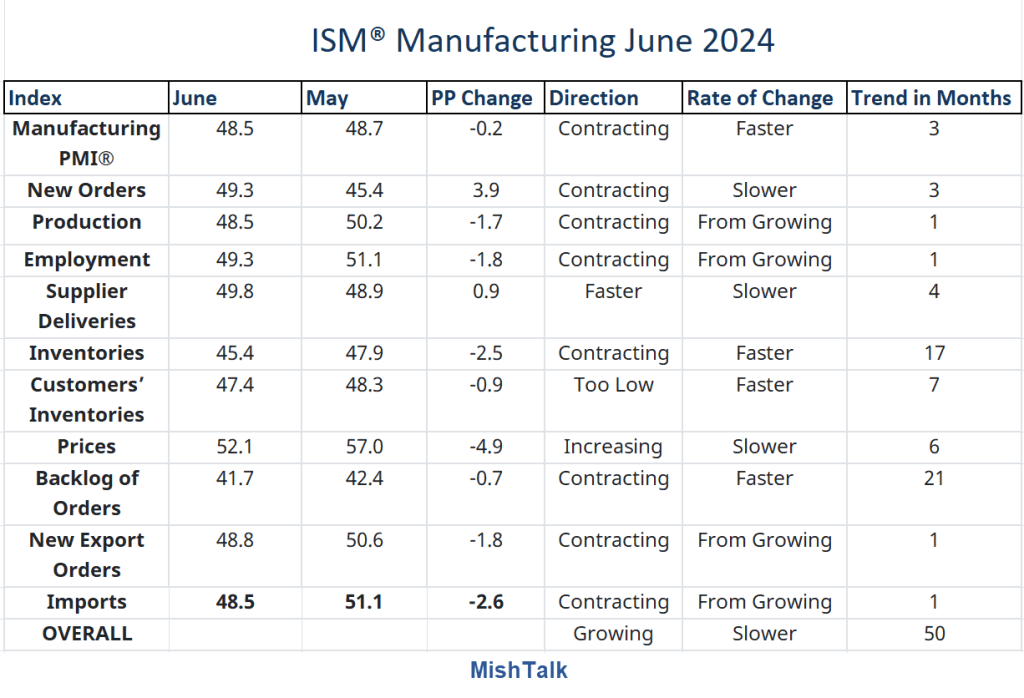

Manufacturing ISM Contracts for the 19th Time in the Last 20 Months

This morning I noticed the change in yields and mentally commented ISM must be super strong. Wrong!

For discussion, please see Manufacturing ISM Contracts for the 19th Time in the Last 20 Months

ISM is “soft data”. But nearly all data continues to weaken. Once again, this looks recessionary.

In isolation, I suspect this will be net negative for GDPNow but it really depends on the model forecast.

My assumption is the forecast did not expect a big drop in production. I will cover this later today.

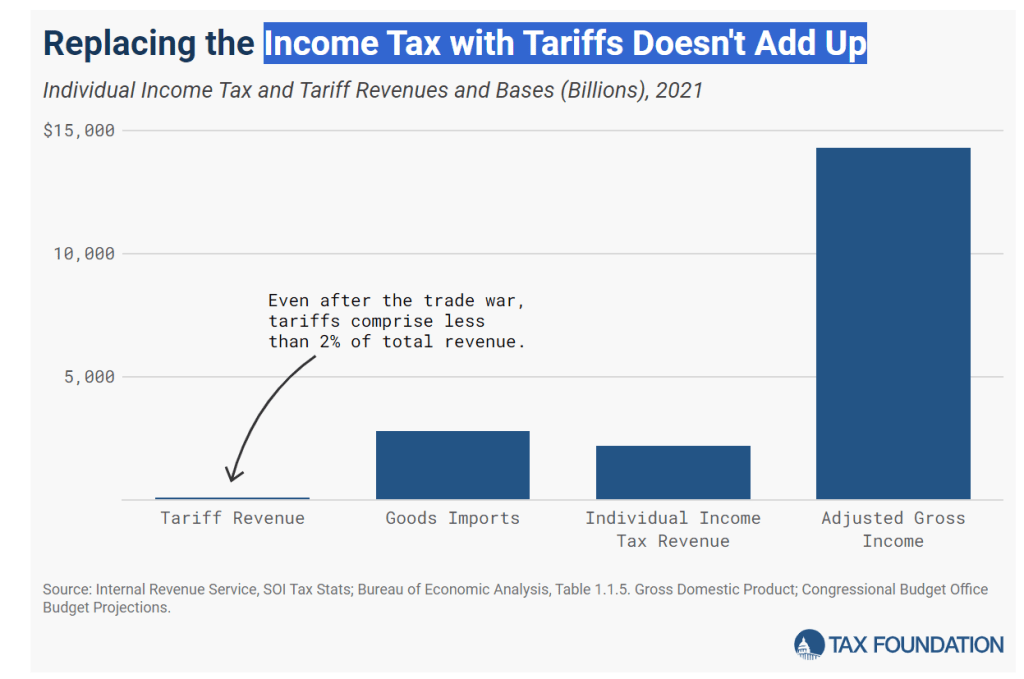

Trump’s Plan to Replace the Income Tax with Tariffs is Economic Nonsense

Trump and Biden are each their own worst enemy. This post is about Trump’s latest tariff gaffe. But he has made similar nonsensical claims before.

The Tax Foundation says “Recent studies on U.S. tariffs have found near 100 percent pass-through of the 2018-2019 trade war tariffs to U.S. importers. That means foreigners have not, directly or indirectly, paid U.S. tariffs—instead, the billions in import taxes raised by the U.S. government have been paid by U.S. businesses and consumers. The economic evidence leaves no dispute that even higher tariffs would further increase costs for American consumers and businesses.”

On June 21, I commented Trump’s Plan to Replace the Income Tax with Tariffs is Economic Nonsense

Mother of All Stagflations

“This is a prescription for the mother of all stagflations,” Summers said on Bloomberg Television’s Wall Street Week with David Westin in regard to replacing a major amount of income-tax revenue with tariffs. It would also create “worldwide economic warfare.”

I don’t often agree with Larry Summers, but that is my take as well.

Massive Trumpian Irony

So here we are with “Yet Another Counterintuitive Sell-Off After Friendly Data“

Yield on the 10-year note rose to 4.48 percent and Mortgage News Daily shows the 30-year mortgage rate rose to 7.14 percent which will hurt housing.

The irony is rising yields increases the odds of recession. And that increases the likelihood of a Trump win.